Dubai, UAE – The Federal Youth Authority (FYA), in collaboration with the Central Bank of the UAE and the Securities and Commodities Authority (SCA), announced the launch of the ‘Youth Financial Advisors Program’, designed to equip Emirati youth to be expert financial advisors with deep knowledge in financial literacy.

The program empowers participants to deliver effective and inspiring financial education by improving the quality of financial decision-making among the youth, encouraging them to save and invest, and educating them to benefit from investment opportunities in the UAE market.

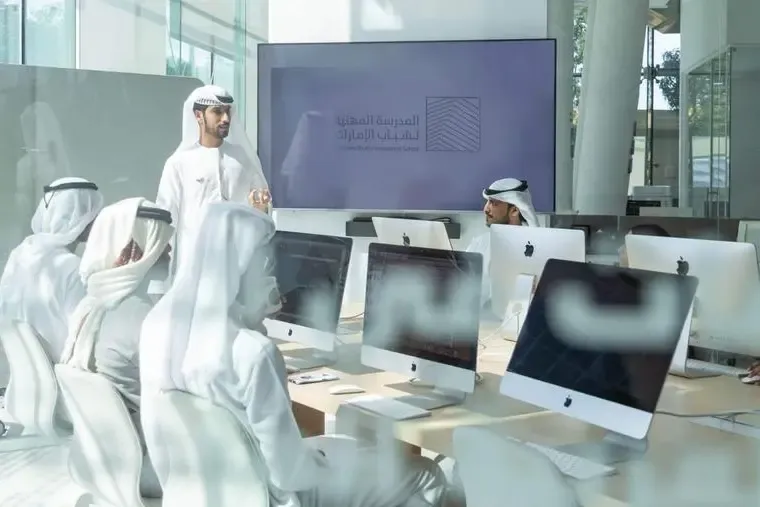

Launched under the ‘Economy’ pillar of the National Youth Agenda 2031, and as part of the Emirates Youth Professional School initiative, the program aims to promote financial awareness and knowledge among young Emiratis, support their path toward financial independence, and encourage them to engage in research and adopt local and international best practices in financial advisory. It also seeks to prepare a generation of Youth financial advisors who can serve as role models in the field of personal finance, while creating promising career paths tailored to the youth that fulfil their aspirations in the labour market.

A fundamental necessity

Commenting on the launch, His Excellency Dr. Sultan bin Saif Al Neyadi, UAE Minister of State for Youth Affairs, said: “The UAE’s wise leadership has long prioritised empowering Emirati youth and arming them with the necessary values and mindset to be active members of the community – a commitment that stems from the leadership’s firm belief that the youth are the backbone of sustainable economic growth. And with that in mind, enhancing young people’s know-how and skillset across various sectors becomes an imperative necessity for moulding a generation of future leaders, capable of playing effective and meaningful roles in the efforts to turn the nation’s aspirations into reality.”

“Promoting financial literacy among young people is a primary element of our national strategy,” H.E. Al Neyadi added. “Enhancing the knowledge and capabilities of the participants in the ‘Youth Financial Advisors Program’ is a fundamental step to ensure their ability to manage their own finances, which lays the foundations for a stable and sustainable future. This forms part of the broader effort to empower national talent and enhance their awareness of the vital role they play in driving the community’s progress and prosperity.”

For his part, H.E. Khaled Mohamed Balama, Governor of the Central Bank of the UAE, said: “Guided by the UAE wise leadership’s vision to empower the youth to be agents of change in the country’s financial sector, the Central Bank of the UAE continues to intensify its efforts to drive financial inclusion and enhance financial awareness and literacy in the wider community.”

“Launching the ‘Youth Financial Advisors Program’ reflects our ongoing commitment to train young Emirati professionals specialising in various financial fields, enable them to actively engage in and contribute to the sector, and support the establishment of a knowledge- and innovation-based economy that ensures sustainable development for generations to come,” H.E. Balama asserted. “The Central Bank’s collaboration with the Federal Youth Authority and our strategic partners is a critical step forward in our effort to develop the youth’s skills, knowledge, and professionalism, preparing them to take up leadership roles that will benefit the future of the financial sector and the UAE’s sustainable development plans.”

Meanwhile, H.E. Waleed Saeed Al Awadhi, CEO of the Securities and Commodities Authority, noted: “We are delighted to be cooperating with the Federal Youth Authority on launching the ‘Youth Financial Advisors Program’, which demonstrates the Authority’s vision for the future and its objectives to support Youth national talent, equipping them with advanced financial knowledge and skills.”

“Investing in Emirati youth is a direct investment in the future of our national economy; they are the engines of innovation and sustainable development in the financial sector,” H.E. Al Awadhi continued. “Through this landmark program, we strive to empower a new generation of financial advisors, capable of adapting to global trends and offering smart financial solutions that promote economic efficiency, enable financial inclusion, and deliver sustainable development, in line with the leadership’s vision for building a globally competitive knowledge-based economy.”

Focus areas and outcomes

The program is built around seven core pillars: financial literacy fundamentals, monetary and financial economics, entrepreneurial finance, finance and investment, financial systems and regulations, content creation, and training skills.

The Federal Youth Authority aims to achieve a set of key outcomes through this program, namely: Advancing financial knowledge; developing practical skills among Youth financial advisors; raising financial awareness among Emirati youth; enabling participants to design and deliver educational content that promotes a culture of sustainable financial literacy; and supporting participants’ journey towards financial independence.

The ‘Youth Financial Advisors Program’ also equips the youth with the knowledge required to pursue internationally recognised certifications in financial literacy.

At the community level, the program promotes the concept of social contribution by having Youth financial advisors offer training to other youths on an hourly, volunteer basis, to share their financial knowledge. It also aims to develop a national network of qualified trainers and financial consultants who can conduct effective financial community awareness programs.

Blending theoretical teaching with hands-on learning, the program is supported by an array of interactive activities spanning a combined 30+ hours of education over a period of four consecutive months. These include in-person workshops for dealing with real-world applications in finance, on-site visits to local and international financial institutions to explore real work environments, and a financial hackathon designed to inspire innovative thinking and novel financial solutions.

Moreover, participants can benefit from professional and practical training through placements in local and international organisations, allowing them to acquire hands-on training. Reading and discussion sessions will also be organised, focusing on financial books and led by experts in their respective fields, in addition to mentorship sessions designed to guide participants’ decisions regarding the main career paths in the field. Additional guidance sessions will be held with local and international experts to facilitate knowledge transfer and highlight best practices in finance consulting.

Requirements and criteria

To participate in the program, applicants must meet a set of criteria, such as being a UAE national, aged between 25 and 32, with a university degree in a relevant field, including business administration, accounting, finance, investment, economics, law, or any other discipline related to the financial sector.

Candidates must also have at least one year of practical experience in one of the abovementioned academic fields, or at least three years of experience in the financial services sector if they do not hold a degree in one of the specified areas. Additionally, they must demonstrate strong communication and leadership skills, clearly express their motivation for participating in the program and the goals they would like to achieve, and be proficient in both Arabic and English.

These criteria ensure participants are well-positioned to benefit from the program and contribute meaningfully to spreading financial literacy across the wider community.

Certification and opportunities

Upon successful completion of all program requirements, participants will receive a certificate of completion issued by the Federal Youth Authority, registered Financial Influencer from the Securities and Commodities Authority, and certified Financial Literacy Trainer from the Central Bank of the UAE.

These qualifications enhance participants’ chances of working as financial advisors and are awarded to those who meet all terms and conditions outlined by the program. They form part of a broader effort to create tangible, lasting impact on the youth, providing them with advanced professional skills that strengthen their presence in the financial and advisory job market.